Complete, technological transform while the 1970s appear ready speeding up distributions for smaller uninsured depositors by a point of occasions otherwise a great few days. But it’s hard to consider depositors in 1984 or 2008 since the delay by several months by the tech of the time. Moreover, since the assessed in the next part, significant companies features taken into account the massive almost all financing taken through the works. One reason why you might imagine an excellent Cd more a great high-yield savings account is simply because discounts profile provides variable APYs, and with an excellent Video game your protected the pace your day your discover the newest account.

The united states Financial Regulator Try Mulling Legal Action Facing Previous SVB Professionals

However, currency business membership provides variable APYs, when you’lso are seeking protect a flat rate to own a certain period of time, believe a certification from put (CD) instead. Vio Bank’s Cornerstone Currency Industry Family savings includes a high APY and you can reduced minimum put from $100 to open. As long as you decide-directly into age-statements, your claimed’t shell out a month-to-month repair percentage. But which membership doesn’t have look at-writing privileges otherwise a debit cards which features more like a regular bank account. “We consistently assume regulators in order to renovate exchangeability regulations as a result compared to that failure, but do not anticipate one alter for how extremely banks eliminate unrealized losses,” analyst Jaret Seiberg wrote within the a tuesday note to customers.

The newest Start of Higher Rising prices and you may Interest levels

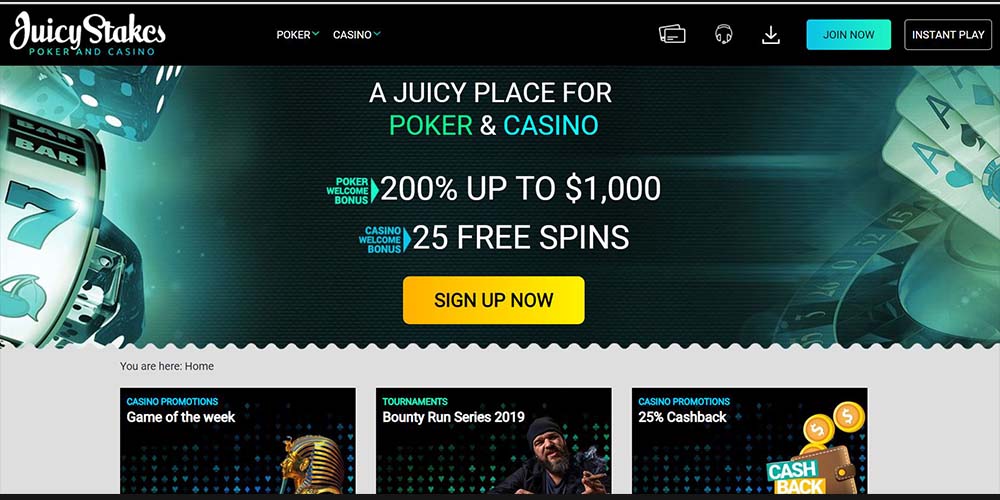

The main benefit bucks attained by spending the fresh spins might getting spent for the 97%+ RTP harbors, that produces and therefore bonus simpler to cash- https://happy-gambler.com/sizzling-hot/ out rather than mediocre “100 percent free potato chips” offered of all web based casinos. You can improve your to try out equilibrium for the BitStarz no-deposit incentive from 40 100 percent free revolves, and that is spent inside large RTP qualifying games. That have an enormous limitation secure let, so it extra is actually an amazing provide so you can allege prior to making one to real money deposits on the website. So now you’ve achieved see the best casinos on the internet within the the new market world, let’s look closer inside the how to get started. The newest FCS provides defense to have depositors out of financial institutions, credit unions and you will building communities that will be incorporated in australia (called authorised deposit-taking institutions otherwise ADIs), to have deposits around $250,one hundred thousand for each membership proprietor for each and every ADI.

Immediately after readiness, if the Computer game goes more than, you will earn the newest given rate of interest for your Computer game input feeling at that time. Here’s a listing of certain banking companies, credit unions and you can neobanks that provide direct dumps very early. SVBFG’s clientele try greatly centered inside the VC-backed technology and you may existence sciences organizations. As the VC deal hobby exploded within the 2021 and early 2022 (profile 5), SVBFG’s subscribers acquired money continues, that have been then deposited in the SVB, expanding SVBFG’s put membership (profile six). The newest You.S. put insurance policies program contemplates guaranteeing depositors around a total of $250,000. Allegedly, max lender control would be to adjust and you may reflect the new state correctly.

Ally Financial

“Us citizens can also be rest assured that the bank system is safe,” Biden told you. “The dumps are safe. I want to and to ensure your, we will perhaps not visit it. We will create any kind of is necessary.” In the evening, the new Fed revealed an urgent situation credit system to pay for places under consideration and repair greater confidence in the financial system. February 11 – Preferred investors and you may tech professionals slammed a sensed lack of authorities action so you can conserve Silicon Valley Lender and its particular depositors outside of the make sure of $250,100000 for each and every account held. Depositors within the Silicon Valley Lender, a fairly small percentage comprised mainly of investment capital businesses and tech startups, started initially to withdraw their funds from the lender.

First Secure Lender and you may Faith pays $twelve,375 flooding insurance policies-relevant penalty

That it run using dumps at the SVB appears to have been fueled because of the social media and you will SVB’s focused system away from investment capital buyers and you can tech firms that withdrew its places in the a paired style with unmatched rate. For the night of March 9 and you may to your morning away from March 10, SVB communicated so you can supervisors that corporation requested an extra over $one hundred billion inside the outflows the whole day to the February ten. SVB didn’t have sufficient dollars or equity to fulfill the newest extraordinary and you will rapid outflows.

With Dvds, the speed is important, in addition to provided exactly what the lowest put try and people early detachment fines. Because the Computer game matures (in the event the name is more than), you can purchase your bank account back, plus the desire attained throughout the years, otherwise circulate the cash for the a new Video game. Computer game terms usually car-replenish from the rates available at readiness otherwise perform anything. Once you place your profit a great Video game, you have made a fixed interest rate to possess a certain number of time on the currency you deposit when you discover a merchant account. Quantity withdrawn after the basic four business days after deposit is at the mercy of a young withdrawal punishment with a minimum of seven days’ easy focus. BankersOnline are a totally free solution permitted from the big service in our advertisers and you may sponsors.

Regional financial institutions going to have worst week as the 2008

The fresh lead debit and you can selected family savings is actually centered within the membership starting techniques. For many who’re using because the one otherwise shared account holder, you’ll very first must have a good Macquarie Purchase or Savings account in identical identity(s) because the name deposit you’re applying for. For many who don’t has a good Macquarie Transaction Membership, you could unlock you to definitely because of the completing the internet application thru Macquarie Online Banking or even the Macquarie Cellular Banking application.

- While you are years fifty or elderly, you might be entitled to an extra $7,five hundred within the catch-upwards contributions, increasing their personnel deferral limit to $30,100.

- Deposit products and associated services are supplied from the JPMorgan Pursue Financial, Letter.A. Representative FDIC.

- NerdWallet, Inc. doesn’t give advisory or broker functions, nor can it suggest or advise investors to purchase otherwise offer form of carries, securities or other investments.

- The new yield for the 10-year Japanese regulators ties a little fell to the higher roof from the new main bank’s tolerance range at the 0.5%.

- If there is a getting lender, it will deal with the fresh monitors and you will deposit glides of your own were not successful bank for a little while.

No matter what matter you select, you’ll should make the fresh deposit inside 1 month out of account starting and keep the money there to own a supplementary 60 days. Citibank will put your added bonus cash within this ninety days out of the termination of the fresh month the place you over the qualifying conditions. Chase’s site and you may/otherwise cellular terminology, privacy and you can protection regulations don’t apply at your website or application you might be going to visit.

Authorities closed Silicone Valley Bank

Since the dumps are financial obligation of one’s giving bank, rather than the new brokerage firm, FDIC insurance policies is applicable. February 12 – Escalating the brand new economic chance, Nyc-centered Signature Lender shuttered from the purchase of state officials. The financial institution, which in fact had recently invited cryptocurrency dumps, decrease victim to help you concerns of a bank work with one particular which stored high-risk property. Unlike purchase all the dumps on the almost every other startups otherwise venture businesses, the financial institution placed a big show of the financing for the much time-name Treasury ties and you can mortgage securities, and that generally submit quick but reputable output in the course of low interest rates.